Kuda Bank Nigeria: Registration & Account Opening, Customer Care, and Others

This article contains everything you need to know about Kuda Bank Nigeria. It contains details about kuda bank account opening and registration, Kuda bank daily account limit and types of bank account, and other information.

Kuda Bank is one of the latest virtual bank apps in Nigeria. This bank only operates online with no physical branches in Nigeria. It is widely accepted by many as a result of the reduction in charges charged by this fintech company. Like all other physical banks, you can buy airtime, send money to friends as well as pay bills with the bank app.

The fintech company was established by Babs Ogundeyi, who is mostly referred to as Kuda Bank CEO. Also, the Kuda Bank Founder has worked at both private and public financing companies before he established the virtual bank. Babs Ogundeyi was also once a Senior Special Adviser on Finance. The online bank is recognized and has been licensed by the Central Bank of Nigeria to carry out different activities.

The popular digital bank is easy to use and the app interface is User-friendly. Furthermore, the app can be used anywhere as long there is an internet connection there. Whether at the home, office or even in a market. With your internet connection, Android, iPhone, or even window, you can create an account with Kuda Bank in Nigeria. Find below details on how to register for Kuda Bank Account in Nigeria and other information.

Read Also: How To Make A Complaint against your Bank to the CBN

Why You Should Register for A Kuda Bank Account in Nigeria

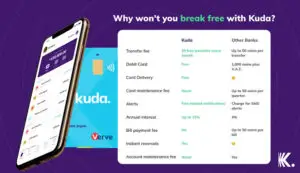

Most Nigerians complain of erratic deductions by the different commercial banks in Nigeria. This is what brings Kuda bank to Nigeria, to solve such problems as well as other benefits gained by the user. Below are some of the reasons you should register for a Kuda bank account in Nigeria.

- There is the provision of a free debit card to all customers who required it, anywhere in Nigeria

- Ability to recharge airtime, pay bills as well as check your bank balance for free.

- There are chances of making 25 bank transfers to another bank every month for free. Before the bank starts charging N10 for other transfers done after.

- Saving on the Kuda app generates high interest with time when compared to the commercial banks.

- No fee is charged for Withdrawal, maintenance of ATM card as well as deposits.

- There is also a chance of earning with the app through referrals which are N200 per person.

Apart from these benefits, there are other benefits that you will gain from registering for a Kuda Bank Account in Nigeria.

Kuda Bank Registration, Account Opening, and Types

Before we highlighted the steps you can use to do your Kuda Bank Registration. Below are the types of accounts offered by Kuda Bank to their various customers.

- Lite Kuda Bank Account

- Basic Kuda Bank Account

- Premium Kuda Bank Account

1. Lite Kuda Bank Account

This is a type of Kuda Bank Account that can be created by anyone and mostly, it’s used to test the app by the user. With only your full name and phone number, you can have this account with Kuda bank.

2. Basic Kuda Bank Account

To register for this Kuda Bank account in Nigeria, you must be able to provide your full name, phone number, and Bank Verification Number (BVN). This Kuda bank account’s daily limit for depositing money is N50,000 with a maximum balance of 300,000.

3. Premium Kuda Bank Account

This account required your full name, phone number, BVN, and a valid ID Card before it can be registered. The daily limit of this bank account is N250,000 for a single transfer while Withdrawal is N30,000 on ATM and 500,000 on POS.

Now, that we have listed different types of Kuda Bank operating in Nigeria, here are the steps needed to open these accounts;

How To Open Kuda Bank Account in Nigeria

Before you can open a Kuda Bank account in Nigeria, you need to download the app first. You can visit the play store if you are using Android or the Apple store and search for the app to download it. Then follow these processes to create your Kuda bank account.

- After installing the app, launch it

- Then press the “join Kuda” button.

- Select your Gender

- Input your date of birth as well as your BVN (if you do not have a BVN, click on the No BVN button instead).

- Press the Continue button and take a picture of yourself for identification.

- After that, you can proceed with the registration by providing your home address

- Enter your phone number, email address as well as password you intend to use.

Note: A one-time password will be sent to the phone number used for confirmation. Ensure you have it with you. - After completing the registration, you can then insert your username and password to login your account

- Once you log in, go ahead to create your уоur Kudа Bаnk Pіn.

- After doing this, уоur Kudа bank Aссоunt Numbеr will be displayed on your screen.

- Congratulations, you just created a Kuda bank account. You can request your Kuda Bank ATM Card anywhere in Nigeria and it will be delivered to you.

How To Use Kuda Bank App in Nigeria

The Kuda Bank app is very easy to use in carrying out different transactions. Whether it’s the transfer of funds, paying off bills and subscriptions, recharging airtime, and so on. All you need is a smartphone or window with a good internet connection to login into your account. You can then go ahead to perform these transactions.

For withdrawal, the Kuda bank ATM card can be used to withdraw and deposit in any POS terminal. You can also deposit and withdraw cash in any Access Bank ATMs. This is because Kuda Bank has partnered with Access Bank for easy withdrawal by their customers.

Also: How To Perform Cardless Withdrawal on Access Bank

kuda Bank Customer Care Number

There are no Kuda Bank branches located physically anywhere in Nigeria. But there are many ways to contact Kuda Bank customer care apart from their number and branches.

Do you have any questions regarding Kuda Bank accounts and other services? Below is the list of ways you can contact Kuda Bank Customer care.

1. Social Media

Fortunately, Kuda bank has pages on different social media platforms where complaints can be lodged by different customers. You can visit their page on Facebook, Twitter, Instagram or even get their Whatsapp number on any of the pages.

2. Kuda App

There is also a Help option in the Kuda app and it can be used to contact the Kuda bank customer care and teams. You can solve your problem by lodging your complaints here.

3. Kuda Office

Even though there are no physical offices of Kuda bank in Nigeria, the digital bank has a head office. The headquarters of Kuda bank is located at 151, Herbert Macaulay Road, Yaba, Lagosolutionsions. You can visit their headquarters to seek solutions to any problems you are facing with the app.

More on Kuda Bank in Nigeria

Although, there may not be a need for using Kuda bank customer care numbers because they do not deduct their customer’s money excessively. Also, their services are optimal and one of the best. But if you need to complain, you can make use of the above-mentioned options. Do we hope you find all this information about Kuda bank in Nigeria helpful?